Clements Worldwide offers new ‘Terrorism Liability’ coverage

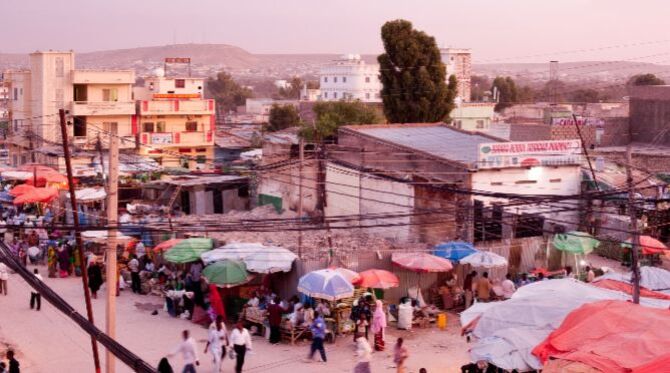

Clements Worldwide is launching a new combined liability coverage for companies operating in high-risk environments like international schools, aid groups, construction companies and oil and gas firms.

Unique protection in developing countries

The new coverage has options for additional extensions, which provides unique protection for risks faced by global organisations operating in developing markets. Perhaps most significant is the new Terrorism Liability Extension. The Terrorism Liability Extension to the Combined Liability Policy delivers added defense from third-party property or bodily injury liability claims linked to a terror attack, previously excluded from most liability policies.Additional extensions available for incidental medical services, abuse and molestation, pollution, and vendors or sub-contractor liability are all critical coverages that were often hard to obtain for multinational organisations.Terrorism liability

Terrorism liability in particular is of growing concern to humanitarian aid groups, government contractors, international schools, construction companies and oil & gas firms that operate in increasingly high-risk environments.The latest Clements Worldwide Risk Index found the number of organisations suffering the effects of a political violence event nearly doubled from a year ago, up 90 per cent over the report issued last spring.“Terror and political violence are on the rise, and affected individuals increasingly turn to the courts for redress,” stated Chris Beck, president of Clements Worldwide.“Adverse legal rulings can seriously damage or even close an international school or small aid group. Clements Worldwide Combined Liability, with its coverage extensions, is a cost-effective way for companies to protect themselves in even riskier operating environments.”Related news:

- Amount of global corruption growing, claims index

- The risks areas of relocation and international assignments

- Are your employees prepared for their relocation to Africa?

Benefits of the Combined Liability policy include flexibility in using the policy as a primary or excess policy, if local liability coverage is mandated. The ability to customise coverage territory, worldwide jurisdiction, and bespoke extensions driven by organisational risk make the offering unique among general liability policies. High-limits ensure organisations are getting the coverage commensurate with the risk.For more information visit: www.clements.com/combinedliabilityFor related news and features, visit our International Assignments section.Access hundreds of global services and suppliers in our Online Directory

Get access to our free Global Mobility Toolkit

Get access to our free Global Mobility Toolkit

©2024 Re:locate magazine, published by Profile Locations, Spray Hill, Hastings Road, Lamberhurst, Kent TN3 8JB. All rights reserved. This publication (or any part thereof) may not be reproduced in any form without the prior written permission of Profile Locations. Profile Locations accepts no liability for the accuracy of the contents or any opinions expressed herein.