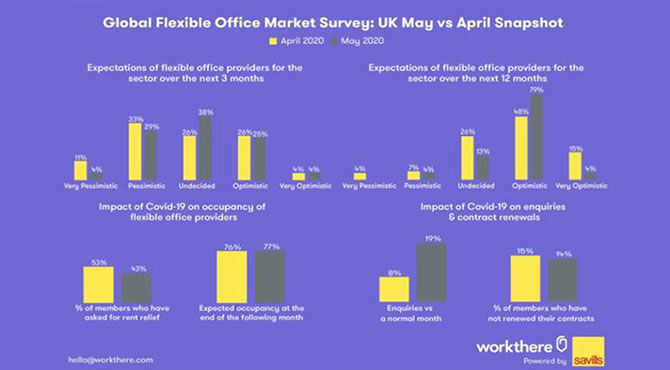

Workthere’s second sentiment survey of flexible office providers has shown that businesses downsizing from a lease is currently the main driver of demand for this type of space in the UK.

This was followed by those searching for suburban office spaces in second place, with corporates taking regional / HQ space ranking third and in joint fourth place was enquiries from those businesses needing additional space due to special distancing and those requiring swing space.

The survey also revealed that overall enquiry levels in the UK for flexible space have more than doubled from 8% of the pre-COVID level of enquiries in April to 19% in May.

Cal Lee, global head of

Workthere, comments: “The rise in enquiry levels for flexible office space in the UK is obviously an encouraging marker and we hope to see these levels continue to increase, albeit most likely at a slower pace as we move forward into the summer months. The fact that we have seen a majority of enquiries coming from businesses looking to move from a traditional lease, and also those looking for suburban office space, is a trend that we also expect to continue as businesses take stock and we move into the next transition phase of COVID-19.

“The current pandemic will be a catalyst for people and companies to reassess current practices in all kinds of ways, and the way we work will be a big part of this. Flexible offices present an option for those companies hesitant to commit to a long term lease at a time of such uncertainty. The sector is also in a good position to play a vital role as office occupiers look to the flexible office market in order to diversify and add resilience to their occupational portfolio.”

When asked for their expected occupancy levels for the following month, the responses were largely the same for the April and May surveys showing 76% and 77% respectively. However, there was a significant decrease in those providers who had been asked for rent relief in May at 43%, down from 53% in April. This supports the overall jump in those UK providers who are optimistic about the prospects for the flexible office sector over the next 12 months with the latest survey showing this figure at 83%, compared to just 63% in April.

Jess Alderson, global research analyst at

Workthere, says: “Our second sentiment survey indicated a number of positive signals for the flexible office market with optimism up among providers and requests for rent relief down. With some businesses now returning to the office and a semblance of a ‘new normal’ for the workplace coming to light, we are also beginning to see the return of some confidence and activity, which the sector can build on.”

For further information, please contact:

Cal Lee, Workthere Tel: +44 (0) 207 409 8807

Jessica Alderson, Workthere research Tel: +44 (0) 207 409 4561

Isabel Stoddart, Savills press office Tel: +44 (0) 758 058 7746

Workthere’s analysis is based on 90 flexible offices around the world, located across Canada, The Czech Republic, France, Germany, Hong Kong, Ireland, Singapore, Spain, The Netherlands, The United Kingdom, The United States and Vietnam. The data was collected via an online survey that we sent by email to flexible office providers. Data was collected during the period of 13

th May 2020 until 21

st May 2020. A ‘member’ is defined as one membership agreement. This could be for one person or one membership agreement for 150 people.

Subscribe to Relocate Extra, our monthly newsletter, to get all the latest international assignments and global mobility news.

Relocate’s new Global Mobility Toolkit provides free information, practical advice and support for HR, global mobility managers and global teams operating overseas. Access hundreds of global services and suppliers in our Online Directory

Access hundreds of global services and suppliers in our Online Directory

©2025 Re:locate magazine, published by Profile Locations, Spray Hill, Hastings Road, Lamberhurst, Kent TN3 8JB. All rights reserved. This publication (or any part thereof) may not be reproduced in any form without the prior written permission of Profile Locations. Profile Locations accepts no liability for the accuracy of the contents or any opinions expressed herein.

Access hundreds of global services and suppliers in our Online Directory

Access hundreds of global services and suppliers in our Online Directory