BP and Rolls-Royce bounce back into profit

Both BP and Rolls-Royce have seen a bounce in profits for the first half of 2017, providing a boost to the stock markets. This follows a poor performance by both companies in 2016.

BP and Rolls-Royce bounce back from 2016

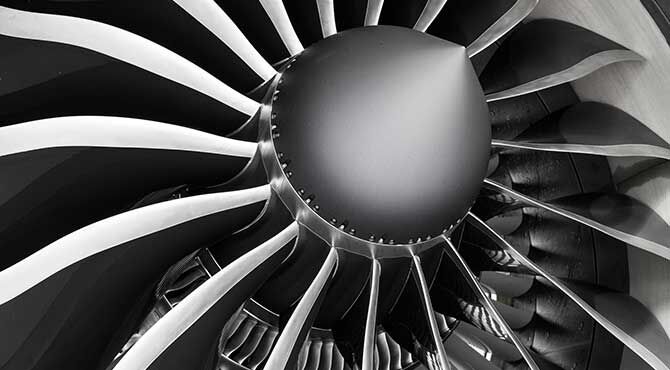

Despite a second quarter hit after abandoning several exploration projects in Angola, BP reported better-than-expected profits for the first six months of 2017 of $1.6 billion (£1.2 billion) compared to a $2 billion (£1.5 billion) loss for the same period last year.Meanwhile, aero engine manufacturer Rolls-Royce notched up a pre-tax, half-year profit of £1.94 billion, up from a £2.15 billion loss over the same period in 2016.BP’s profits in Q2 were only $144 million (£109 million) compared to $1.4 billion (£1.1 billion) in the first quarter, mainly as a result of a $753 million loss from the Angola pull-out.Bob Dudley, BP chief executive, said, “We continue to position BP for the new oil price environment, with a continued tight focus on costs, efficiency and discipline in capital spending.“We delivered strong operational performance in the first half of 2017 and have considerable strategic momentum coming into the rest of the year and 2018, with rising production from our new upstream projects and marketing growth in the downstream.”The company, which recorded upstream production growth of ten per cent in Q2, said three new upstream projects had come online so far this year, while gas projects in India and Trinidad had also been sanctioned.Looking ahead, Mr Dudley said BP would continue with a “tight focus on costs, efficiency and discipline in capital spending”.In the second quarter, the charges resulting from the 2010 Gulf of Mexico oil rig disaster, which killed 11 workers and caused America’s worst ever environmental disaster, came in at $347 million, far lower than the hit of $5.1 billion a year earlier.“While net debt rose primarily due to Gulf of Mexico payments, we expect this will improve over the second half as these payments decline and divestment proceeds come in towards the end of the year,” said Brian Gilvary, BP chief financial officer.BP said the total cost of the disaster to the company to date, including fines and compensation to businesses, stood at more than $63 billion (£47.6 billion).Large engine deliveries boost for Rolls-Royce

Meanwhile, Rolls-Royce saw its fortunes improve on the back of a 27 per cent rise in large engine deliveries to the civilian aerospace sector, which helped revenues climb 12 per cent to £7.75 billion.Over 2016 as a whole, the company had a pre-tax loss of £4.64 billion, largely as a result in the collapse of the value of the pound after the Brexit vote and a £671 million penalty to settle bribery allegations. CEO Warren East said restructuring savings were now ahead of schedule and that the company was on track to hit its profit targets.Related stories:

- BP back in the black as oil prices rise

- Trends in the global oil and gas industry

- UK inflation rate in surprise fall in June

“Rolls-Royce delivered encouraging year-on-year operational progress in the first six months of the year,” he said. “Civil Aerospace large engine deliveries increased 27 per cent and we made good further progress improving Trent XWB OE economics.“Together with a higher-than-expected benefit from long-term contract accounting adjustments, this resulted in a good set of results, with financial performance ahead of our expectations for the first half.“Looking to the balance of the year, execution and delivery of a number of important milestones across our businesses will be key to achieving our full year expectations. Our outlook for full-year profit and cash remains unchanged.“Two years ago we set out a programme of change at Rolls-Royce to drive efficiency and sharpen our focus on execution.“Our strengthened management team is making good progress in simplifying the organisation and driving the pace of necessary change to develop a more resilient and sustainable business. However, this is no time for complacency.“Strong execution and a focus on delivering our customer commitments remains essential as we continue to manage in-service issues in civil aerospace alongside key new product introductions and increased production volumes.”The company revealed in June that it would safeguard more than 7,000 jobs by making a £150 million investment in new and existing plant, including a new testing facility at its Derby site.For related news and features, visit our Enterprise section.Access hundreds of global services and suppliers in our Online Directory

Get access to our free Global Mobility Toolkit

Get access to our free Global Mobility Toolkit

©2024 Re:locate magazine, published by Profile Locations, Spray Hill, Hastings Road, Lamberhurst, Kent TN3 8JB. All rights reserved. This publication (or any part thereof) may not be reproduced in any form without the prior written permission of Profile Locations. Profile Locations accepts no liability for the accuracy of the contents or any opinions expressed herein.