Serviced apartments: fast forward?

How is the serviced apartment sector responding to the demands of business travellers and employee relocation? Is compliance still top of the agenda for employers? We investigate the growing trends.

The impact of aparthotels on the serviced apartments sector

The new wave of aparthotels will help to scale up the volume and bring the benefits of trackability, ease of booking, and compliance checks. Whether it is a studio or a two-bedroom apartment, this type of extended-stay accommodation is really taking off with employees on the move.The 24-hour reception and being able to check in at any time of day or night will be a reassurance to weary travellers arriving in an unfamiliar district. The warm welcome will be appreciated as much as the ‘arriving home’ feel when you open your own front door and can kick off your shoes, unwind, and do exactly as you want, whether that is making a meal, watching TV, catching up with work, or just relaxing in your own space.EXTENDED STAY EXPLAINED

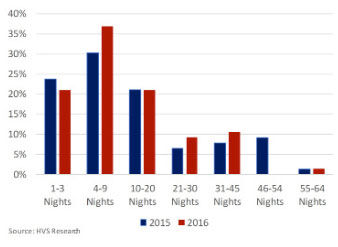

Those on an international assignment or a domestic relocation move for a number of weeks know what is in store, and they like the serviced apartments option. But as HR increasingly becomes the custodian of the safety and security of all their company’s mobile employees – even business travellers – the benefits of serviced apartments for even a few nights are becoming clear.The business traveller is now much more on the corporate radar because of changes in business style, the need for a rapid response to projects and business requirements, and, of course, cost constraints. See the evidence in the latest RES Forum survey.But here is the conundrum. Companies know there is business out there, across the globe, and they need to be able to respond quickly, mobilising their talent as fast as possible to stay ahead of the competition.

Further reading from the Autumn issue of our magazine:

- Technology in the workplace: supporting global mobility

- Global mobility programmes and compliance: latest trends

It is the whole picture of the anticipated experience that helps them to decide where they will spend that leisure weekend. They expect the same in the work context.With the rise of Airbnb, the genie is out of the bottle. Most people have tried it and liked it in their personal lives, and many, it seems, want to ‘live like a native’ when they are away on business. However, as debated at the recent Serviced Apartment Summit session on business travel and relocation, for many employers and their employees it is primarily about length of stay, a good product, security, proximity, and ease of getting to work. The traditional serviced apartment model is perfect for this.

Rise of urban lifestyle aparthotels

Many of the established brands known to the corporate relocation market have moved with the times and now offer urban travel and stay, concept or lifestyle ranges.First on the scene was Netherlands operator Zuko, which provides social spaces where guests can work, eat, and meet kindred spirits. It has been followed this year by Yays, which is making its mark with three properties. BridgeStreet has responded by growing its Mode and Studyo aparthotel brands, with a focus on European and US capital and gateway cities.SACO launched its first Locke-branded apartments in London. Edinburgh followed this summer, and Amsterdam is in the pipeline. Frasers Hospitality’s offering is Capri, which was launched in Asia and is making its way into Europe. The Ascott is embracing the concept with its new lifestyle brand, Lyf. It aims to have 10,000 units under the brand globally by 2020, and is looking at sites in the UK, France, Germany, Australia, Malaysia, Indonesia, Japan, Singapore and Thailand.Ascott’s refurbished Citadines brand also captures the ethos. The newly renovated Citadines Barbican was launched this summer with a fresh, contemporary look and a collaboration with Sourced Market that offers a food-and-drink market and fresh, seasonal meals seven days a week right next to the reception.Meanwhile, on the Continent, reflecting different price points and designer chic, NEST Geneva offers accommodation to die for, for those discerning upper-strata decision-makers who want their lifestyle to flow across business and pleasure wherever they go.Serviced offices reflect the growing urban lifestyle trend

Interestingly, Savills reports a substantial increase in serviced-office take-up this year, not only in London but also, increasingly, in the rest of the UK. In particular, large transactions have taken place in Birmingham, Reading and Manchester, where WeWork took 55,802 square feet at 1 Spinningfields.Savills notes that one of the key drivers behind the rise in popularity of serviced offices is the expansion of the tech sector and, more specifically, start-ups and scale-ups. Cal Lee, head of new Savills venture Workthere, says, “Flexibility in terms of space and lease is vital for a tech company, or indeed any fast-growing business. Whether they are two people or 50, in a month they could be ten or 100 respectively, and therefore the flexibility allows them to grow and adapt at their own pace, letting the space work around their business.“In many cases, a conventional lease simply does not meet the requirements of these fast-growing businesses that tend to think in one, two or three years, rather than five or ten.”Savills is increasingly seeing larger firms and corporates recognising the benefits of having a presence in a serviced office environment, “as it provides them with an opportunity to integrate and collaborate with these new and creative companies as well as access a growing talent pool”.It appears that serviced office and serviced apartment providers are moving in the same direction, reflecting changes in attitudes to the workplace and lifestyle. Global communications and advertising agency Saatchi & Saatchi’s new London HQ at 40 Chancery Lane (after 40 years in Charlotte Street, Fitzrovia), described as ‘British with a twist’, is one example.“Saatchi & Saatchi wanted guests to feel as if they are stepping directly into the agency, not a holding reception before the real thing,” noted project architect Andre Nave, of Jump Studios. “They were keen to subvert the traditional office in multiple ways, which meant we could create a truly effective space. It’s not every day that a client allows you to use Rachel Whiteread’s Ghost House, Grayson Perry pottery, and Paul Smith suits as inspiration for their HQ.”Inside, a traditional ground-floor reception area has been dispensed with in favour of an open-plan social hub that enables visitors to mix with employees as soon as they arrive and gain immediate insight to the philosophy and creative approach of Saatchi & Saatchi.Airbnb joins the serviced apartments establishment?

The bugbear for the serviced apartments sector in recent years has been the rise of disrupter Airbnb. However, the ‘bad boys’ are now integrating with the wider temporary accommodation proposition. In 2015, BridgeStreet embraced its potential competitor by introducing a partnership with Airbnb. Many providers upload their inventory to Airbnb when they have vacancies.UNPICKING SERVICED APARTMENT JARGON

We know that corporates with strong global mobility compliance awareness, like Grant Thornton, signed up early with Airbnb for certain uses and demographics, and other corporates have followed. HR and global mobility specialists have to fight their cause in their organisations on the compliance and duty-of-care front. In the end, it is a corporate decision. Weighing up the risk factor is what organisations do across their businesses every day.However the disrupters are joining forces, and a new body, the Short Term Accommodation Association (STTA), which may bring reassurance to some employers, has been launched.The STTA states that the UK’s sharing economy has been predicted to expand by more than 30 per cent per year over the next decade, generating £18 billion of revenue for platforms and facilitating about £140 billion-worth of transactions per year by 2025. The association has been launched to keep the public and politicians informed, particularly as the 90-day ruling has been confirmed. As the agenda unfurls, watch this space.

Get access to our free Global Mobility Toolkit

Get access to our free Global Mobility Toolkit  © 2017. This article first appeared in the Autumn 2017 edition of Relocate magazine, published by Profile Locations, Spray Hill, Hastings Road, Lamberhurst, Kent TN3 8JB. All rights reserved. This publication (or any part thereof) may not be reproduced in any form without the prior written permission of Profile Locations. Profile Locations accepts no liability for the accuracy of the contents or any opinions expressed herein.

© 2017. This article first appeared in the Autumn 2017 edition of Relocate magazine, published by Profile Locations, Spray Hill, Hastings Road, Lamberhurst, Kent TN3 8JB. All rights reserved. This publication (or any part thereof) may not be reproduced in any form without the prior written permission of Profile Locations. Profile Locations accepts no liability for the accuracy of the contents or any opinions expressed herein.