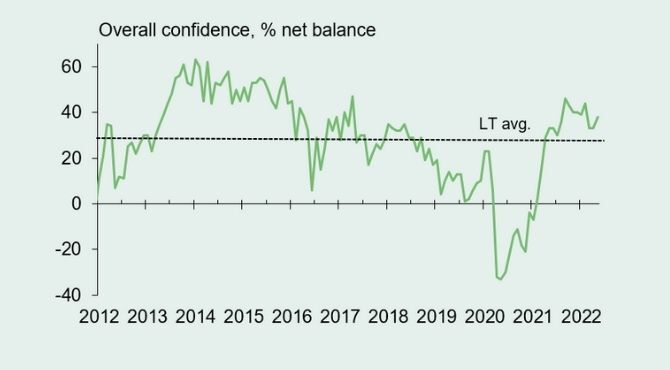

UK business confidence starts to return

Business confidence bounced back across most of the UK in May despite continuing global supply chain problems, the war in Ukraine and rising inflation.

Source: Lloyds Bank Business Barometer (May 2022), BVA BDRC

1 June 2022

1 June 2022London was the clear leader in renewed optimism with the barometer recording a 23-point rise in confidence to 68% with businesses reporting plans to target growth opportunities in the next six months, including entering into new markets (55%), investing in their teams (49%) and evolving their business offering (33%).

Despite global problems the UK bounced back from inflation rises

In all, eight of the UK’s twelve regions or nations reported higher business confidence last month. In addition to the capital, strong gains were seen in the West Midlands (up 11 points to 53%), NW England (up 12 points to 44%), Scotland (up 14 points to 42%) and Northern Ireland (up eight points to 41%).By contrast, the confidence of companies in the East of England fell 20 points to 14%, while Yorkshire & Humber and SE England both saw falls of seven points, to 34% and 23%, respectively.

Confidence varied in different sectors, with retail recording a two-point fall while construction notched up a 21-point rise. There was a slight rise in manufacturing confidence while the services sector reached a three-month high, increasing four points to 36%.

Paul Gordon, managing director for SME and mid-corporates at Lloyds Bank Commercial Banking, said: “It is reassuring to see a number of positives coming out this month as businesses show that despite challenges, confidence is increasing once again. However, it is understandable that there continues to be caution around the future, given inflationary pressures and potential for economic slowdown.

Related articles:

“In response, businesses should ensure they keep a tight rein on input costs to help support profit margins and keep working closely with their suppliers and customers to ensure any changes in supply or demand are noticed in good time."

Despite the increase in overall business confidence, Lloyds found that almost half of the businesses in the survey cited higher costs as one of their biggest concerns over the next six months, while a third were most concerned about an economic slowdown.

"As a result, businesses are likely to respond by focusing on building in financial and operational resilience, including through strong working capital management and optimising inventory levels, while working closely with their suppliers and customers," reported Lloyds.

According to the barometer, 53% of firms were now planning to increase the size of their workforce - the second highest level seen since the start of the pandemic.

Read more news and views from David Sapsted in the Spring 2022 issue of Think Global People.

Join us at the Future of Work Festival on 9 June to explore these topics further and be part of a unique experience driving innovation and collaboration for growth. Book tickets here.

Subscribe to Relocate Extra, our monthly newsletter, to get all the latest international assignments and global mobility news.Relocate’s new Global Mobility Toolkit provides free information, practical advice and support for HR, global mobility managers and global teams operating overseas.

Access hundreds of global services and suppliers in our Online Directory

Access hundreds of global services and suppliers in our Online Directory ©2025 Re:locate magazine, published by Profile Locations, Spray Hill, Hastings Road, Lamberhurst, Kent TN3 8JB. All rights reserved. This publication (or any part thereof) may not be reproduced in any form without the prior written permission of Profile Locations. Profile Locations accepts no liability for the accuracy of the contents or any opinions expressed herein.