Intermark report: supply and demand for housing in Moscow rising

Analysis of the Moscow housing market in first half of 2017 by Intermark has shown supply and demand on the rise. The average tenants budget has also increased significantly since 2016.

Housing supply in Moscow

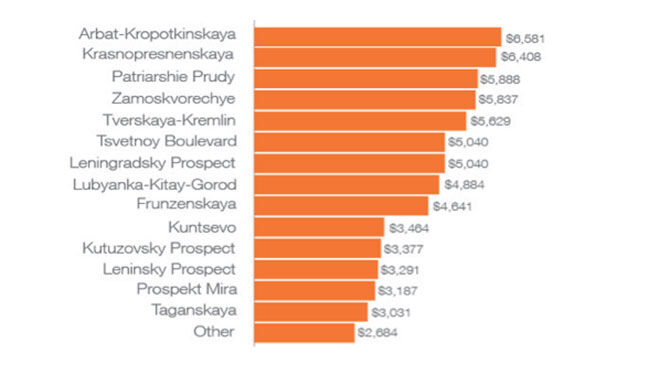

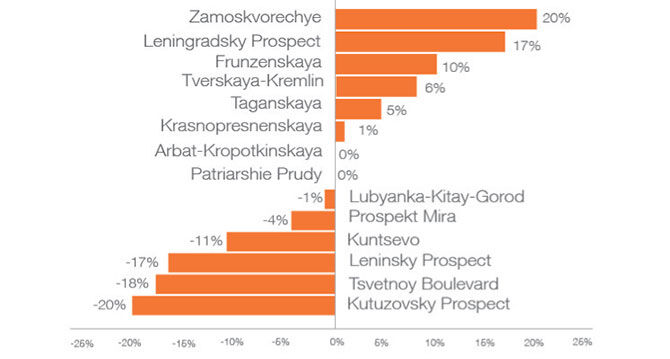

Over the past three years, the volume of high-budget apartments for rent in Moscow has increased by approximately a quarter (26 per cent). Over the past year, the largest increase in supply has been observed in three districts: Zamoskvorechye (+20 per cent), Leningradsky Prospekt (+17 per cent) and Frunzenskaya (+10 per cent).A noticeable decrease in availability of high-budget apartments from June 2016 was found in Kutuzovsky Prospekt (-20 per cent) and Tsvetnoy Boulevard (-18 per cent).The top three districts in terms of supply are Arbat-Kropotkinskaya area, with 20 per cent of market share, Tverskaya – Kremlin and Zamoskvorechye areas, with 15 per cent and 10 per cent of all lots, respectively.

Housing demand in Moscow

In June 2017, demand from potential tenants was 8 per cent higher compared to the same period two years earlier.The volume of demand from tenants has increased by 15 per cent from the end of 2016 to the present (when comparing the period from November to December 2016 and May to June 2017).Leningradsky Prospect is traditionally the most popular district in the high-budget rental market in Moscow. Since the beginning of the year, apartments in this area were of interest to almost 16 per cent of all potential tenants.Related stories:

- Global house prices rise at fastest rate in two years

- China continues to dominate growth in global house price rises

- German cities maintain strong rental price growth

The second most popular location for rent is Arbat-Kropotkinskaya, at 10 per cent of all requests.Compared to the same period last year, the average tenant budget has increased – $4,716 against $3,650 in 2016. More than a quarter (28 per cent) of all tenants is interested in renting an apartment at around $2,000-$4,000 per month.

Access hundreds of global services and suppliers in our Online Directory

Access hundreds of global services and suppliers in our Online Directory

©2026 Re:locate magazine, published by Profile Locations, Spray Hill, Hastings Road, Lamberhurst, Kent TN3 8JB. All rights reserved. This publication (or any part thereof) may not be reproduced in any form without the prior written permission of Profile Locations. Profile Locations accepts no liability for the accuracy of the contents or any opinions expressed herein.