UK house price growth remains flat among southern cities

Hometrack’s latest UK Cities House Price Index reveals a north-south divide in price growth, as southern cities remain flat. Edinburgh now tops the list as the fastest rate of growth in the UK.

London house price growth stalls

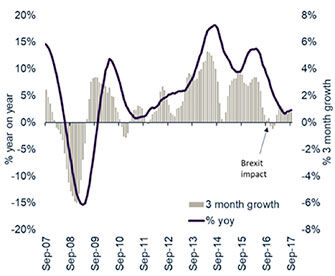

Average house prices in the capital increased by 0.5 per cent in the three months to September 2017 as the annual rate of growth reached 2.3 per cent on the back of lower turnover. However, with the general rate of Consumer Price Index inflation running at 3 per cent the index shows that in 85 per cent of the areas covered by the London City index house prices are now falling in real terms.

Cambridge and other southern cities prices fall flat

House price growth across many southern cities also remains flat. In Cambridge (2.3 per cent), Oxford (2.3 per cent) and Cardiff (2.4 per cent) the annual rate of growth is below the general rate of inflation.In contrast, the Hometrack index reveals that cities in Scotland have seen acceleration in house price growth.Housing sales in Scotland over the last quarter have increased by 20 per cent when compared to the previous 12 months (according to the HMRC). While London sits towards the foot of the 20-city index growth league table, Scotland’s capital Edinburgh now tops the list of UK cities ranked by price growth at 6.7 per cent.Manchester has dropped to second place with annual growth of 6.5 per cent followed by Birmingham at 5.9 per cent.____________________________________________

Prices in Scotland continue to improve with Glasgow leading growth

Glasgow has also registered a significant uptick in house price growth, rising from 1.8 per cent a year ago to 5.6 per cent today.Meanwhile, in Aberdeen house prices have been falling for the last 2.5 years but the year on year growth rate of – 1.8 per cent is the slowest rate of price falls for 2 years.Overall the headline rate of annual growth across UK cities is running at 4.9 per cent compared to 6 per cent twelve months ago.Further reading for residential property:

- London sees first home price drop since 2009

- Estate & letting agents: help relocating families with our free UK Education Guide

- Hometrack ups forecast for property price rise

Mortgage rate increase expected to affect growth

Mr Donnell said that a possible increase in interest rates and any knock-on effect for mortgages, is also likely to further temper demand.He continued, “A modest increase in mortgage rates will primarily impact sentiment and levels of market activity.“Mortgage rates remain low by historic standards and for the last three years, all homeowners buying with a mortgage have had to prove they can afford a much higher mortgage rate.“As a result, recent sales levels already reflect the ability of buyers to afford higher borrowing costs which should mean there is capacity for borrowers to absorb increased monthly repayments.”Relocate Global's Guide to Education & Schools in the UK 2017 is packed with expert education advice for those who are relocating and the professionals supporting them. Access your FREE digital copy here.For related news and features, visit our Residential Property section.Relocate’s new Global Mobility Toolkit provides free information, practical advice and support for HR, global mobility managers and global teams operating overseas. Access hundreds of global services and suppliers in our Online Directory

Access hundreds of global services and suppliers in our Online Directory

©2026 Re:locate magazine, published by Profile Locations, Spray Hill, Hastings Road, Lamberhurst, Kent TN3 8JB. All rights reserved. This publication (or any part thereof) may not be reproduced in any form without the prior written permission of Profile Locations. Profile Locations accepts no liability for the accuracy of the contents or any opinions expressed herein.