More U.S expats eye renouncing citizenship

A quarter of American expats across the world are considering renouncing US citizenship because of the tax burden imposed on them by Washington, according to a new survey

20 June 2022

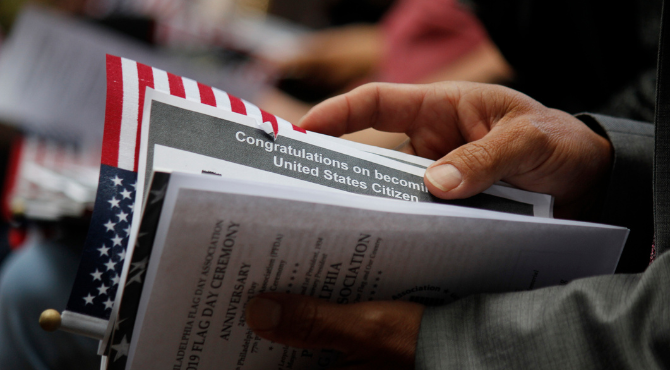

20 June 2022US expats no long want to continue their US citizenship due to the tax burden imposed on them

The IRS rules requiring American expats to pay US taxes on overseas incomes and investments was by far the main reason why respondents were considering giving up citizenship, although other reasons cited included concerns over the current political climate in the US.Additionally, some 12% had married a non-US citizen while abroad and 8% said they had difficulty working with foreign banks as an American citizen. More than three-quarters of those surveyed felt they should not be required to pay US taxes while living abroad.

“You have people doing what seems to them like very normal things, such as saving for retirement or buying a home,” said David McKeegan, co-founder of Michigan-based Greenback. “But when you do it overseas, sometimes you can get yourself into a whole lot of trouble.”

American expats pay taxes in two countries

American expats must pay annual US income taxes on worldwide earnings, including their salaries, business profits, investment income and more, which involves filing and paying taxes in two countries."While the US has measures to prevent double taxation, such as the foreign income exclusion and tax credit," CNBC reported at the weekend, "many expats still oppose the dual filing requirements due to the time commitment and expense of preparing those returns. What’s more, nearly 80% don’t feel they should have to pay US taxes while living abroad, the survey finds.

"Additionally, some Americans must report foreign accounts to the US Department of the Treasury annually via the Report of Foreign Bank and Financial Accounts, or FBAR, or potentially face stiff penalties."

There are estimated to be about nine million US citizens living across the world. Among respondents to the Greenback survey, only ten per cent said they had plans to return to the US permanently, while 41% were unsure and 49% said they no plans to return permanently.

"Most of those surveyed do not have plans to return to the US permanently. Some indicated they were unsure due to the uncertainty surrounding the Coronavirus pandemic, future employment opportunities, and personal ties in the US and abroad," said Greenback.

In 2020, a record 6,705 Americans renounced US citizenship. Last year, the number dropped to just 2,426, which has been largely attributed to the number of US embassies closed because of the pandemic.

Other findings from the survey:

- 46% of US expats 'completely' or somewhat disapproved of how Washington had handled the Covid-19 crisis.

- A majority indicated that they planned to work remotely at least some of the time.

- 86% of those surveyed felt the US government was less likely to address their issues than those of stateside citizens.

Related news:

Read more news and views from David Sapsted in the Spring 2022 issue of Think Global People.

Subscribe to Relocate Extra, our monthly newsletter, to get all the latest international assignments and global mobility news.Relocate’s new Global Mobility Toolkit provides free information, practical advice and support for HR, global mobility managers and global teams operating overseas.

Access hundreds of global services and suppliers in our Online Directory

Access hundreds of global services and suppliers in our Online Directory ©2026 Re:locate magazine, published by Profile Locations, Spray Hill, Hastings Road, Lamberhurst, Kent TN3 8JB. All rights reserved. This publication (or any part thereof) may not be reproduced in any form without the prior written permission of Profile Locations. Profile Locations accepts no liability for the accuracy of the contents or any opinions expressed herein.